ny paid family leave tax 2021

Enter another line Non-taxable NY Paid Family Leave in the description and the same amount as a NEGATIVE. Ad Register and Subscribe Now to work on your Hartford App for NY Paid Family Leave Benefits.

Paid Parental Leave Around The World And How The U S Compares The Washington Post

New Yorks Paid Family Leave program provides employees with job-protected paid time off to bond with a newly born adopted or fostered child care for a family.

. No deductions for PFL are taken from a businesses tax contributions. Benefits for 2021 67 Wage Benefits Receive 67 of your average weekly wage up to a cap. The PayServ implementation of the NY Paid Family Leave program has resulted in a new procedure to updating eligible employees who may have applied for a waiver or do not meet the eligibility criteria as.

Employers are required to purchase a PFL insurance policy or self-insure. The PFL employee contribution rate is unchanged from 2021. And Withholding Tax Revised December 2021 NYS-50 1221.

The weekly contribution rate for Paid Family Leave in 2020 is 0270 of the employees weekly wage capped at New Yorks current average annual wage of per employee per year. Average weekly wage of 145017. In New Jersey go to Other Non-Wage IncomeYou will see a Description and Amount from your employers 1099-MISC.

READ THE FULL BULLETIN. The New York Department of Financial Services announced. The New York Workers Compensation Board announced that the employee contribution rate for Paid Family Leave PFL insurance will remain at 0511 for 2022 up to the current statewide average weekly wage SAWW of 159457 capped at the maximum contribution of 42371.

The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current. Therefore a maximum contribution of 741 per week per employee in 2021 regardless of age gender or. New York States Paid Family Leave PFL law provides partial income replacement and job protection while workers are on leave for covered reasons.

Comprehensive Paid Family Leave policy into law. Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions. The New York Department of Financial Services has released the community rate for New York Paid Family Leave effective January 1 2021.

Up to 12 Weeks of Leave. The New York State Department of Financial Services has announced that the 2021 premium rate and the maximum weekly employee contribution for coverage will be 0511 000511 of an employees weekly wage. The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a maximum annual contribution of 38534.

See Why Were Americas 1 Tax Preparer. Employee Notice of Paid Family Leave Payroll Deduction for 2021. Family Leave Insurance benefits are subject to federal income tax and to federal rules on reporting income and paying taxes.

NY Paid Family Leave Update Employee Tax Data Paid Family Leave Waiver. The maximum weekly benefit for 2022 is 106836. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

In November 2021 Governor Kathy Hochul signed legislation to further strengthen Paid Family Leave by expanding family care to cover siblings effective January 1 2023. On December 23 2020 the Office of the State Comptroller issued State Agencies Bulletin No. Paid Family Leave provides eligible employees job-protected paid time off.

For 2021 the contribution. Paid Family Leave may also be available for use in situations when you or your minor dependent child are under an order of quarantine or isolation due to COVID-19. If an employer chooses to hire a temporary employee to replace a regular employee while they are on Paid Family Leave could.

In 2021 employees will be able to use up to 12 weeks of leave and receive up to 67 of their. Ad File Your State And Federal Taxes With TurboTax. In 2021 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage of 145017.

Employee Notice of Paid Family Leave Payroll Deduction for 2021. Employers may collect the cost of Paid Family Leave through payroll deductions. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

See If You Qualify To File State And Federal For Free With TurboTax Free Edition. In 2022 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage of 159457. Last week was the Democrats turn to fail.

A 12-week paid family and medical leave program costing 500 billion over 10 years was supposed to be a. Please visit the state Paid Family Leave website for a list of. The maximum employee premium deduction for Paid Family Leave will be 38534 per year.

This amount is be deducted from employees post-tax income and is appear on their paystubs as a post-tax deduction. 2192021 110829 AM. For more information visit PaidFamilyLeavenygov or call the Paid Family Leave Helpline for assistance at 844 337-6303.

The Paid Family Leave wage replacement benefit is also increasing. The maximum weekly benefit for 2021 is 97161. 1887 to inform agencies of the 2021 rate for the New York State Paid Family Leave Program.

The Paid Family Leave wage replacement benefit is increasing. 1 PDF editor e-sign platform data collection form builder solution in a single app. See PaidFamilyLeavenygovCOVID19 for full details.

The Department explains the steep increase in the 2021 payroll deduction rate is due to the PFL benefits increasing to 12 weeks of leave at 67 of pay the high utilization of the benefit and the rise in the cost of coverage. They are however reportable as income for IRS and NYS tax purposes.

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

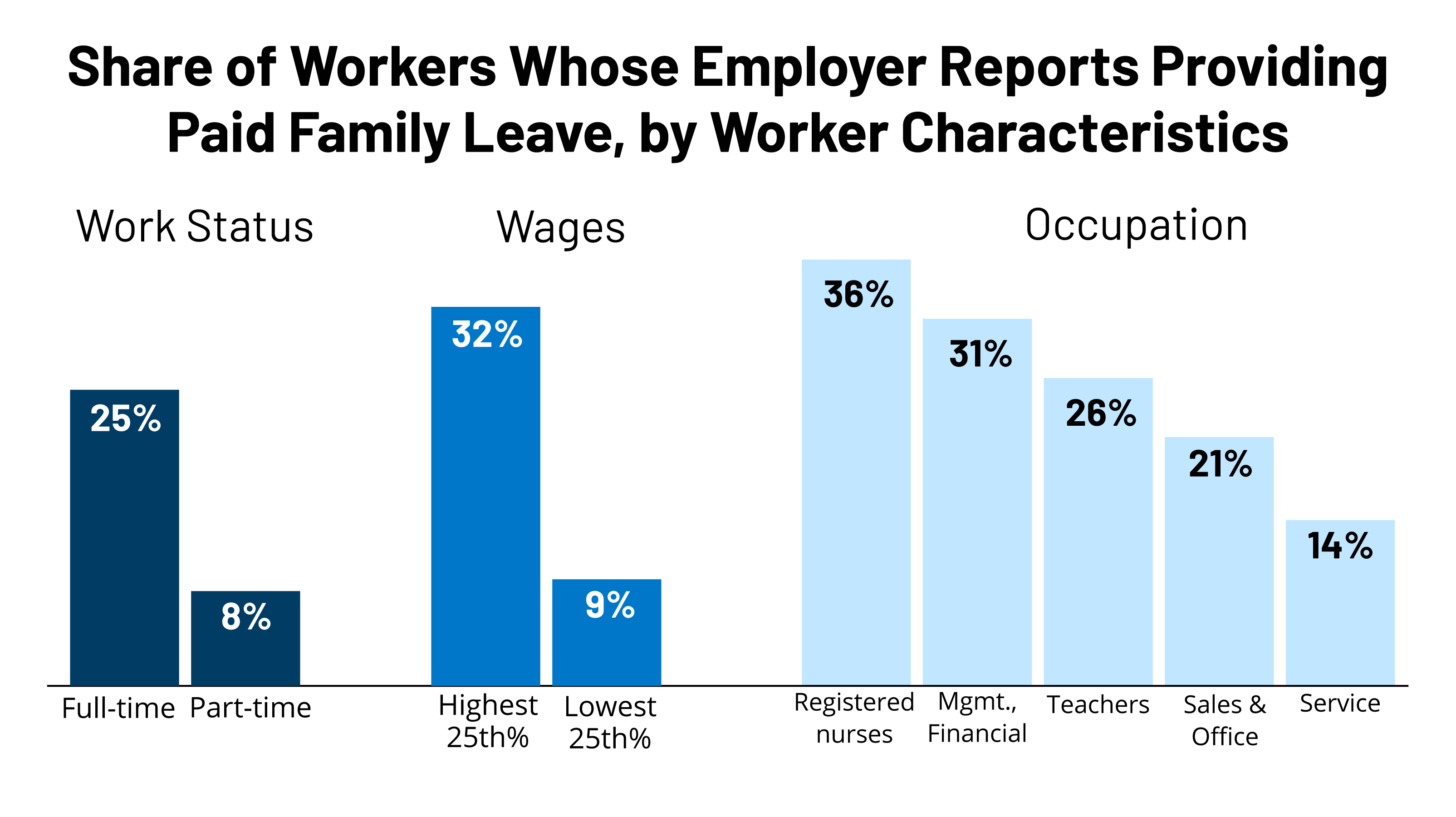

Explainer Paid Leave Benefits And Funding In The United States

Why We Talk About Paid Family Leave In Only Economic Terms Time

New York State Paid Family Leave Cornell University Division Of Human Resources

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

Universal Paid Family And Medical Leave Under Consideration In Congress Kff

New York Paid Family Leave Ny Pfl The Hartford

Universal Paid Family And Medical Leave Under Consideration In Congress Kff

New National Paid Leave Proposals Explained

Everything In The House Democrats Budget Bill The New York Times

New York Paid Family Leave Updates For 2022 Paid Family Leave

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

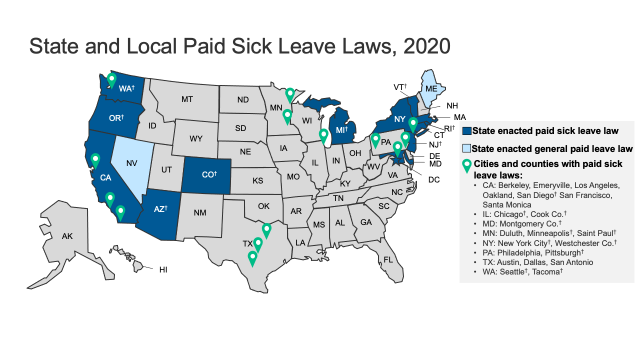

Paid Sick Leave Laws By State Chart Map And More